Are you thinking about creating an app like Venmo? One of the first questions that probably comes to mind is, “How much does it cost to develop an app like Venmo?”

The cost to develop such an app typically ranges between $30,000 to $250,000, depending on factors like the app’s complexity, design, and features.

In this blog, we’ll guide you through everything you need to know about building a Venmo-like app, including essential features, cost breakdowns, development steps, and monetization strategies.

By the end, you’ll have a clear idea of what it takes to bring your app vision to life.

Understanding Venmo: The E-Wallet Revolution

Venmo has become synonymous with seamless peer-to-peer transactions, revolutionizing the way we handle money.

Owned by PayPal, Venmo allows users to send, receive, and manage funds instantly while adding a social twist with transaction feeds and emojis.

With over 90 million active users in 2024, Venmo processes billions in transactions annually.

Its popularity stems from its unique blend of simplicity and advanced features, making it a go-to app for everything from splitting dinner bills to paying rent.

What makes Venmo stand out?

It’s not just about sending money, it’s about the experience.

Users enjoy a platform that’s as social as it is functional, with secure integrations and intuitive designs that cater to modern lifestyles.

Thinking of creating your own version of Venmo? Let’s dive into the features that make it tick.

Essential Features for a Venmo-Like App

Building an app like Venmo requires a mix of essential and advanced features that cater to user needs while ensuring seamless functionality.

Here’s a list of 15 must-have features to consider:

1. User Registration and Authentication

Offer multiple sign-up options, such as email, phone numbers, and social media accounts, for a hassle-free onboarding process.

2. User Profiles

Allow users to create and manage personal profiles, including details like profile pictures, email addresses, and payment methods.

3. Peer-to-Peer Money Transfer

Enable instant money transfers between users, with added options for notes or emojis for a personalized experience.

4. Transaction History

Provide users with a detailed view of their past transactions, including dates, amounts, and recipients.

5. Split Payment Feature

Make group payments easier by allowing users to split bills and specify individual shares.

Add a unique touch by showcasing transaction details (without amounts) on a shared feed to create a social element.

7. Bank Account and Card Linking

Allow users to securely link their bank accounts or credit/debit cards for funding their wallets.

8. QR Code Payments

Introduce QR codes for quick payments, especially useful for in-person transactions.

9. Push Notifications

Keep users informed with notifications about successful transfers, failed attempts, and promotional updates.

10. Multi-Currency Support

For global reach, allow transactions in multiple currencies with automatic exchange rates.

11. Two-Factor Authentication (2FA)

Enhance security with 2FA, ensuring only authorized users can access accounts.

12. In-App Wallet

Include a digital wallet feature that lets users store money directly in the app for quick payments.

13. Cryptocurrency Integration

Appeal to modern users by offering the option to send and receive payments in cryptocurrencies.

14. Admin Dashboard

Provide a back-end dashboard for managing users, tracking transactions, and ensuring app compliance.

15. Customer Support Integration

Include a chatbot or live chat feature to assist users with any issues they encounter.

These features form the foundation of your app. With the right blend of simplicity and innovation, you can create an app that rivals Venmo.

Reasons to Create an App Like Venmo in 2025

The demand for cashless payments is at an all-time high, and apps like Venmo have set the stage for a revolution in how people manage money.

If you’re considering developing an eWallet app, 2025 presents a golden opportunity.

Let’s explore the top reasons to create an app like Venmo, supported by real-world statistics.

1. The Explosive Growth of Mobile Payment Markets

The global mobile payment market is on a meteoric rise.

It’s projected to surpass $12.06 trillion by 2027, growing at a robust 23.8% compound annual growth rate (CAGR).

As smartphone penetration continues to increase and consumers become more comfortable with digital financial solutions, the potential user base for apps like Venmo grows exponentially.

This makes the market ripe for new entrants who can provide innovative solutions tailored to specific demographics or geographies.

2. Rising Demand for Seamless and Cashless Transactions

The world is quickly moving toward a cashless economy, with over 70% of all payments predicted to be digital by 2025.

Post-pandemic, consumers have fully embraced the convenience, speed, and security of mobile transactions.

Whether it’s splitting bills, paying friends, or purchasing from small businesses, people expect instant and effortless payment options.

A Venmo-like app aligns perfectly with these evolving preferences, ensuring a strong user adoption rate right from the start.

3. Enormous Revenue Potential

Apps like Venmo are not just about convenience; they’re also incredible revenue generators.

For instance, Venmo reported a revenue of approximately $935 million in 2023, primarily driven by small transaction fees, instant money transfer fees, and strategic merchant partnerships.

Businesses and developers can tap into multiple revenue streams, such as:

- Transaction Fees: Earn a percentage on every transaction made via the app.

- Merchant Services: Collaborate with businesses to provide seamless payment integrations.

- Subscription Models: Offer premium features like enhanced limits or zero fees for a monthly charge.

By introducing innovative monetization strategies, you can maximize your return on investment while providing value to your users.

In summary, the increasing market size, growing cashless trend, and revenue-generating capabilities make developing a Venmo-like app an excellent business opportunity for 2025.

With the right features and strategies, your app could become the next big name in digital payments.

Average Cost to Develop an App Like Venmo

So, how much does it cost to develop an app like Venmo?

On average, the cost to develop an app like Venmo ranges between $30,000 and $250,000. This wide range is influenced by several factors, such as the complexity of features, app design, development approach, and team expertise.

Here’s a breakdown of eWallet app development cost:

| Development Stage | Cost Range ($) |

| Basic MVP Development | $30,000 – $60,000 |

| Full-Feature Development | $70,000 – $150,000 |

| Advanced Features (e.g., AI, Crypto) | $150,000 – $250,000 |

It’s worth noting that the geographical location of your development team can also influence costs.

Hiring developers in North America might cost between $80 to $200 per hour, while teams in Eastern Europe or South Asia charge $30 to $80 per hour.

By understanding these cost ranges, you can better plan your budget and make informed decisions about the scale and scope of your app.

Factors That Affect the Cost to Develop an App Like Venmo

The cost of developing an app like Venmo is influenced by multiple factors, each playing a crucial role in determining the overall budget.

Understanding these factors can help you allocate your resources effectively and ensure the app aligns with your vision.

Below are the most impactful cost factors, along with their estimated influence on the budget.

1. App Features and Complexity

The more features you include, the higher the cost.

Core features like peer-to-peer payments, transaction history, and user profiles are essential, but advanced functionalities like cryptocurrency integration or social feeds significantly increase development time and cost.

| Feature Type | Cost Range ($) |

| Basic Features | $15,000 – $30,000 |

| Advanced Features | $50,000 – $100,000 |

2. App Design

A clean and intuitive user interface (UI) paired with an excellent user experience (UX) ensures that users stay engaged.

Complex, custom designs will require more time and expertise, raising development costs.

Here’s breakdown of design cost:

| Design Complexity | Cost Range ($) |

| Simple Design | $5,000 – $10,000 |

| Custom/Complex Design | $20,000 – $50,000 |

3. Platform Selection

Choosing between iOS app development, Android app development, or both impacts the cost.

While developing for a single platform is more budget-friendly, cross-platform apps increase reach but require higher investment.

| Platform | Cost Range ($) |

| Single Platform | $30,000 – $80,000 |

| Cross-Platform | $50,000 – $150,000 |

4. Development Team Location

The hourly rate for developers varies by region.

While teams in the U.S. or Europe charge more, developers in South Asia or Eastern Europe offer cost-effective solutions without compromising quality.

| Region | Hourly Rate ($) |

| North America | $80 – $200 |

| Eastern Europe | $30 – $70 |

| South Asia | $20 – $50 |

5. Backend Development

The app’s backend is the backbone of its functionality, managing servers, databases, and APIs.

The complexity of backend architecture impacts development costs significantly.

| Backend Complexity | Cost Range ($) |

| Basic Backend | $10,000 – $25,000 |

| Advanced Backend | $40,000 – $100,000 |

6. Third-Party Integrations

Integrating third-party services like payment gateways (e.g., PayPal, Stripe), messaging services, or analytics tools adds functionality but also increases costs.

| Integration Type | Cost Range ($) |

| Basic Payment Gateway | $5,000 – $15,000 |

| Advanced APIs | $20,000 – $40,000 |

7. Security Features

Robust security measures like two-factor authentication, encryption, and fraud detection are essential for payment apps, adding to the development budget.

| Security Type | Cost Range ($) |

| Basic Security | $5,000 – $10,000 |

| Advanced Security | $20,000 – $50,000 |

8. Maintenance and Updates

The cost of eWallet maintaining and updating the app post-launch is an ongoing expense that should be factored into your budget.

| Maintenance Plan | Cost Range ($) |

| Basic Maintenance | $1,000 – $5,000/month |

| Advanced Maintenance | $10,000+/month |

9. Testing and QA

Rigorous testing ensures the app is free of bugs and performs seamlessly across devices and platforms.

The complexity of features affects QA costs.

| Testing Type | Cost Range ($) |

| Basic QA | $5,000 – $10,000 |

| Comprehensive QA | $15,000 – $30,000 |

By understanding these factors, you can better plan your app’s development and allocate your budget efficiently.

Steps to Create an App Like Venmo

Creating an app like Venmo requires careful planning and execution.

Below is a brief development process to guide you through the journey, ensuring you cover all the critical stages effectively:

1. Market Research and Planning

- Understand your target audience, their pain points, and how your app will solve their problems.

- Analyze competitors like Venmo to identify gaps and opportunities in the market.

- Outline your app’s unique selling proposition (USP) and create a detailed feature list.

2. Choose the Right Tech Stack

- Select technologies suited for eWallet apps, such as Kotlin or Swift for the frontend, and Node.js or Python for the backend.

- Integrate secure payment gateways like PayPal, Stripe, or Square for seamless transactions.

3. Design the User Interface (UI) and User Experience (UX)

- Focus on intuitive navigation and a clean interface to make the app user-friendly.

- Use wireframes and prototypes to test your app’s flow before finalizing the design.

4. Develop the MVP (Minimum Viable Product)

- Start with essential features like user registration, peer-to-peer transfers, and transaction history.

- Test the MVP to gather feedback and refine the app before moving to full-scale development.

5. Backend Development and Integration

- Build a robust backend to manage user data, transactions, and security.

- Integrate third-party services, including payment processors and APIs for functionality like QR code payments or multi-currency support.

6. Quality Assurance (QA) and Testing

- Perform rigorous testing to identify and fix bugs.

- Ensure the app performs smoothly across different devices, operating systems, and network conditions.

7. Deployment and Launch

- Publish your app on platforms like the Apple App Store and Google Play Store.

- Plan a soft launch to gather early user feedback and make adjustments before a broader rollout.

8. Post-Launch Maintenance

- Regularly update the app to add new features, fix issues, and enhance security.

- Monitor user behavior and analytics to optimize the app’s performance and user engagement.

By following these steps, you can create a Venmo-like app that not only meets market demands but also sets you apart from the competition.

App Development Timeline

The timeline to develop an app like Venmo largely depends on the complexity of the features, the size of the development team, and the overall scope of the project.

On average, it can take anywhere between 4 to 12 months to complete the development process.

Here’s a breakdown of the estimated time for each stage of development:

| Development Stage | Estimated Time |

| Market Research and Planning | 2-4 weeks |

| UI/UX Design | 4-6 weeks |

| Backend and Frontend Development | 12-20 weeks |

| Integration of Third-Party APIs | 2-4 weeks |

| Quality Assurance and Testing | 4-6 weeks |

| Deployment and Launch | 1-2 weeks |

A clear timeline ensures that your project remains on track and achieves its goals within the desired time frame.

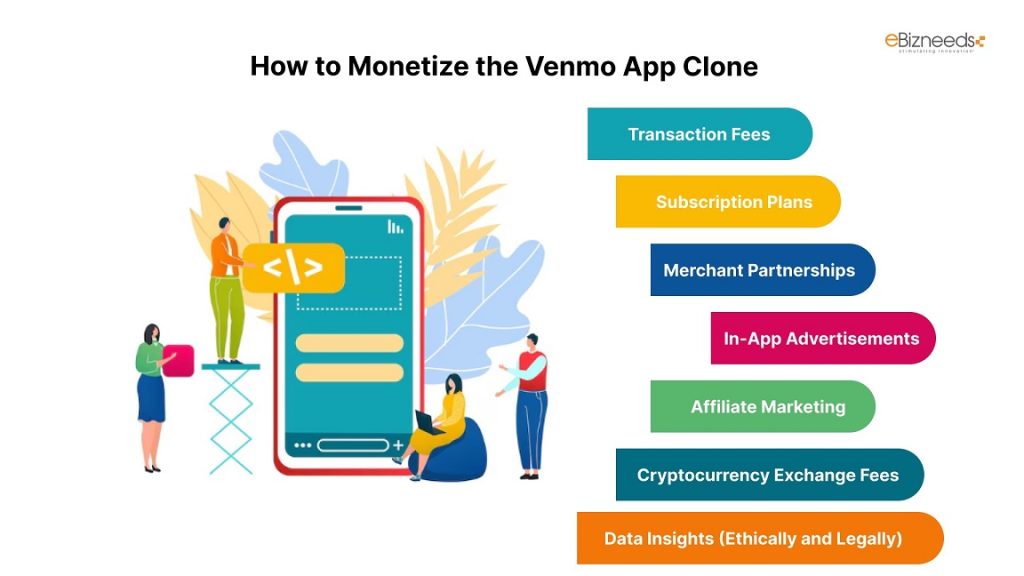

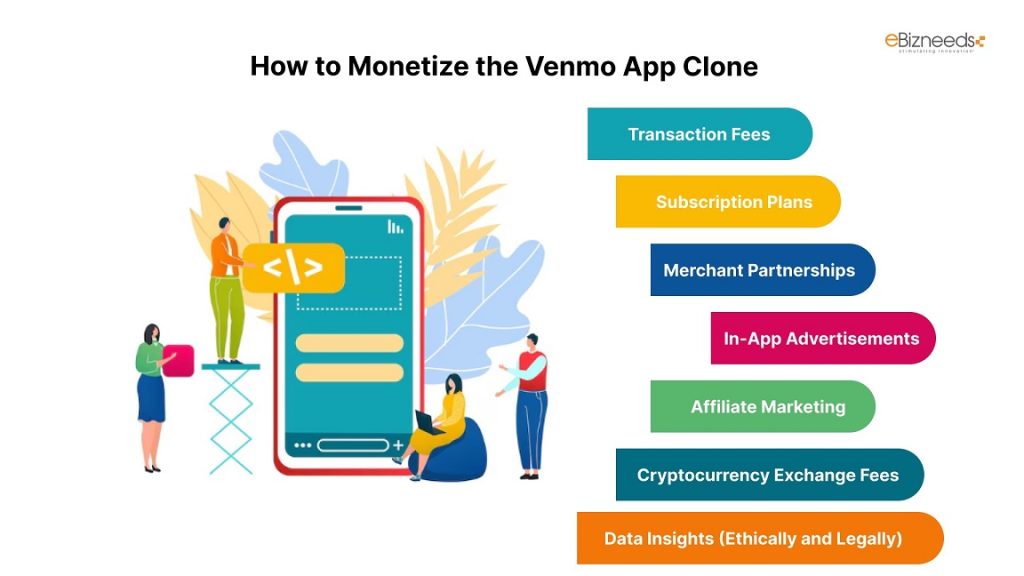

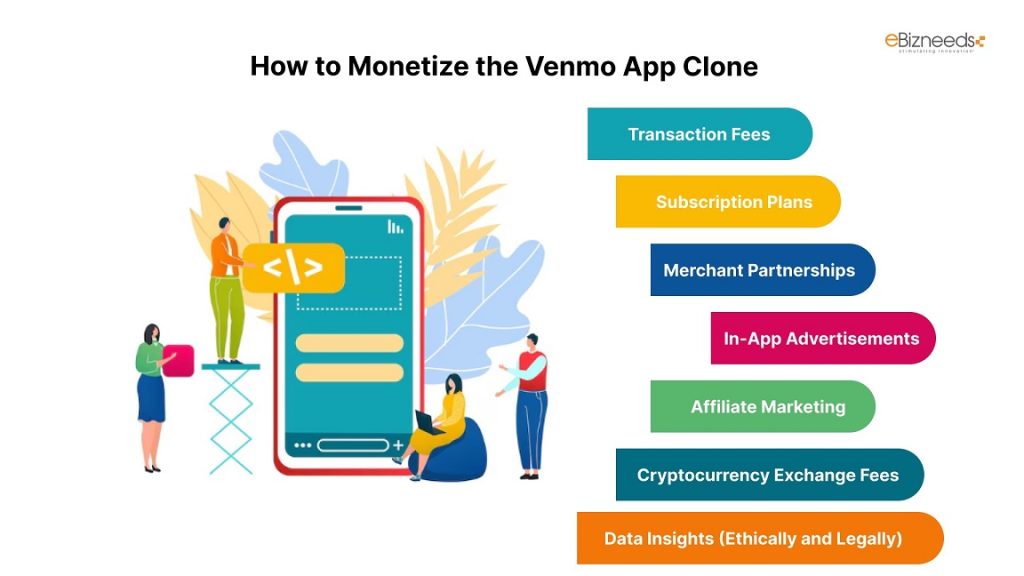

Monetizing a Venmo App Clone

Developing an app like Venmo is not just about facilitating transactions, it’s also a great way to generate revenue.

Below are some proven monetization strategies you can adopt, along with the revenue potential for each:

1. Transaction Fees

Charge users a small fee for specific types of transactions, such as instant bank transfers.

Venmo, for example, charges 1.75% (minimum $0.25) for instant transfers. This model ensures a steady income stream as transaction volume grows.

Revenue Potential

If your app processes $10 million in transactions monthly, you could earn $175,000 per month with a 1.75% fee.

2. Subscription Plans

Offer premium features, such as higher transaction limits, zero-fee transfers, or priority customer support, through a subscription model.

Example

Charge $5/month for a “Pro” version with exclusive perks. With 100,000 users subscribing, that’s $500,000 in monthly revenue.

3. Merchant Partnerships

Collaborate with merchants to allow users to make purchases directly through your app.

Charge merchants a fee (e.g., 2-3%) for every transaction completed via your platform.

Revenue Potential

With $1 million in monthly merchant transactions, a 2% fee generates $20,000 per month.

4. In-App Advertisements

Use targeted ads within your app, especially if it includes a social feed or transaction history feature.

Offer merchants or brands advertising space to reach your user base.

Revenue Potential

If your app has 1 million active users, charging $20 CPM (cost per 1,000 impressions) for ads could generate significant passive income.

5. Affiliate Marketing

Partner with financial services like credit card providers or banks.

Promote their services through your app and earn a commission for every user who signs up via your platform.

Revenue Potential

Earn $10-50 per successful referral, depending on the partnership terms.

6. Cryptocurrency Exchange Fees

If you integrate cryptocurrency support, charge users a small percentage for buying, selling, or transferring crypto through your app.

Revenue Potential

With $1 million in monthly crypto transactions, a 2% fee could yield $20,000 monthly.

7. Data Insights (Ethically and Legally)

Aggregate and anonymize user behavior data to provide valuable market insights to businesses.

Ensure compliance with privacy regulations like GDPR and CCPA.

Revenue Potential

Selling insights to merchants or financial institutions could generate $10,000+ monthly.

These monetization strategies, when implemented effectively, ensure a high return on investment (ROI) while adding value to users and merchants alike. By combining multiple streams, you can maximize the app’s revenue potential.

eBizneeds – Your Partner in App Development

Looking to bring your Venmo-like app idea to life? eBizneeds is here to turn your vision into reality. With years of experience in developing cutting-edge eWallet applications, we specialize in creating apps tailored to your business goals.

At eBizneeds, we offer:

- Expert Development Team: Skilled developers experienced in building secure and scalable eWallet apps.

- Custom Solutions: Apps designed to meet your unique requirements and target audience.

- End-to-End Support: From ideation to post-launch maintenance, we’re with you every step of the way.

- Cost-Effective Services: High-quality solutions that fit within your budget.

Ready to build your app? Let eBizneeds, a trusted eWallet app development company, be your partner in success. Contact us today to get started!

Conclusion

Developing an app like Venmo is not just a smart move in today’s digital economy — it’s a step toward capitalizing on the growing demand for seamless, cashless payment solutions. With features like peer-to-peer transfers, transaction histories, and social elements, a Venmo-like app has the potential to attract millions of users and generate substantial revenue.

While the cost to develop an app like Venmo can range between $30,000 to $250,000, this investment depends on the complexity of features, design, and integrations. By carefully planning your app’s development, prioritizing essential functionalities, and adopting proven monetization strategies, you can create a product that stands out in the competitive eWallet market.

FAQs

The cost ranges from $30,000 to $250,000, depending on the features, complexity, platform choice, and development team.

Key features include user registration, peer-to-peer payments, transaction history, social feed integration, and robust security measures like two-factor authentication.

It typically takes 4 to 12 months, depending on the app’s scope, features, and complexity.

Popular strategies include transaction fees, subscription plans, merchant partnerships, in-app advertisements, and cryptocurrency exchange fees.

eBizneeds offers expert developers, custom solutions, and end-to-end support to ensure your app’s success—all while delivering cost-effective services.

Naveen Khanna is the CEO of eBizneeds, a company renowned for its bespoke web and mobile app development. By delivering high-end modern solutions all over the globe, Naveen takes pleasure in sharing his rich experiences and views on emerging technological trends. He has worked in many domains, from education, entertainment, banking, manufacturing, healthcare, and real estate, sharing rich experience in delivering innovative solutions.