In the insurance industry, the customer identifies whether the company actually stands on its promises during the claim intimation stage. At claim intimation, the company can break or build its reputation. Thus, the claim processing system should be frictionless for the customers as well as for the claim managers. Building a claim processing software will streamline all the related tasks of insurance claims to a great extent. It will automate workflows, streamline claim processing, and utilise AI to identify any fraudulent claims.

Many leading insurance companies are not employing digital solutions for significant improvements. In this article, we will go through various aspects of insurance claims processing system development. Let’s begin with the basics…

What is Insurance Claims Processing Software?

Claims processing software is designed to speed up and streamline the overall claim processing cycle of insurance. It will take the claim intimation request, intake the data, settle the claims, and provide reporting. It will eliminate most of the manual efforts required and minimise low-value tasks. Thus, the employees are free and can work on more complex cases.

An insurance claims processing software relies on artificial intelligence (AI) to enable analytics-based claim decisions. AI helps in accurately calculating the damage and instant detection of insurance fraud. The software will not just improve customer experience but will also significantly reduce operational costs.

As a leading insurance software development company, we also leverage technologies like blockchain, IoT, and AR to introduce automated claiming capabilities for policyholders. It supports seamless loss adjustment and payouts across innovative insurance models.

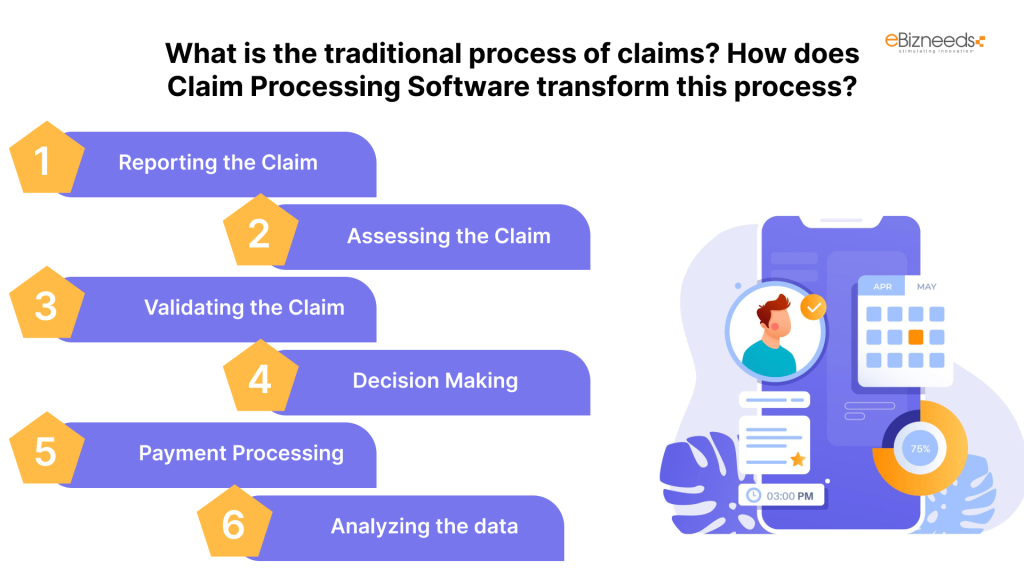

What is the traditional process of claims? How does Claim Processing Software transform this process?

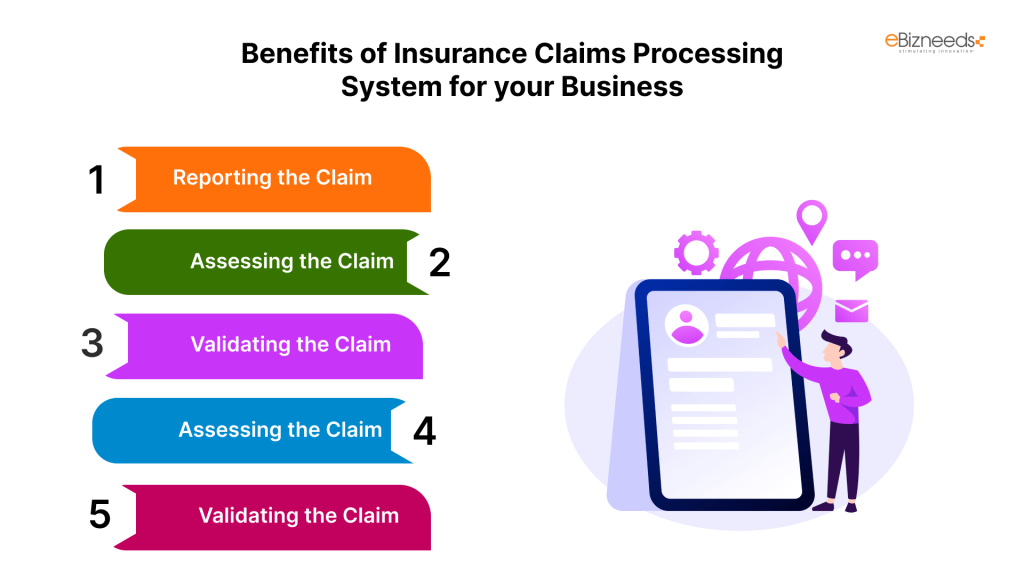

These are the steps involved in traditional claims processing:

1. Reporting the Claim:

At the initial level, the customer or policyholder reports a first notice of loss (FNOL) to the insurance firm.

The claim processing system development will allow claims submission through a mobile or online.

2. Assessing the Claim:

Now after the intimation, the claim handler reviews the policy to see what is covered.

This step can be automated to detect a particular policy language and consult 3rd party databases to verify the identity of the claimant.

3. Validating the Claim:

The insurer gathers additional information, including repair estimates or medical records, to validate the claim.

The software will pull the data from various sources to help validate the claim faster and more accurately.

4. Decision Making:

During the decision-making stage, the insurance company either has to give claim approval or reject the claim.

There can final check with the possible involvement of humans, however, the rest of the process will be automated with pre-defined rules and specifying payment amounts and coverage.

5. Payment Processing:

If the decision is to approve the claim, the insurer is bound to initiate the payment to the insured party.

With an automated payment process, there will be higher accuracy and speed.

6. Analyzing the data:

When the claim process is completed, a lot of data will be generated regarding the claim type, customer history, nature of the claim, etc. This data can be analyzed for future perspectives.

Automation systems can assist in the analysis of claims data and the identification of consumer behaviour patterns, hence warning of any potential fraud and identifying improvement opportunities.

Benefits of Insurance Claims Processing System Development for your Business

An Insurance claims processing software offers a plethora of benefits, including:

a. Reduced Claim Management Cost:

The smart tools of insurance software will significantly improve the operational efficiency of your existing system. It will save significant cost and time.

b. Faster Claims Settlement:

In insurance, faster claim settlement helps you get a competitive edge over your competitors. It will simplify the entire process for yourself and policyholders by bringing automation in claims.

c. End-to-End Visibility:

You get complete visibility of the timeline of the claims management through insurance claim software.

d. Minimal Claims Leakage:

Equip your team with the ability to analyze the collected claims data to identify potential leakage.

e. Improved Customer Satisfaction:

The faster and smoother claims settlement will help you exceed customer expectations.

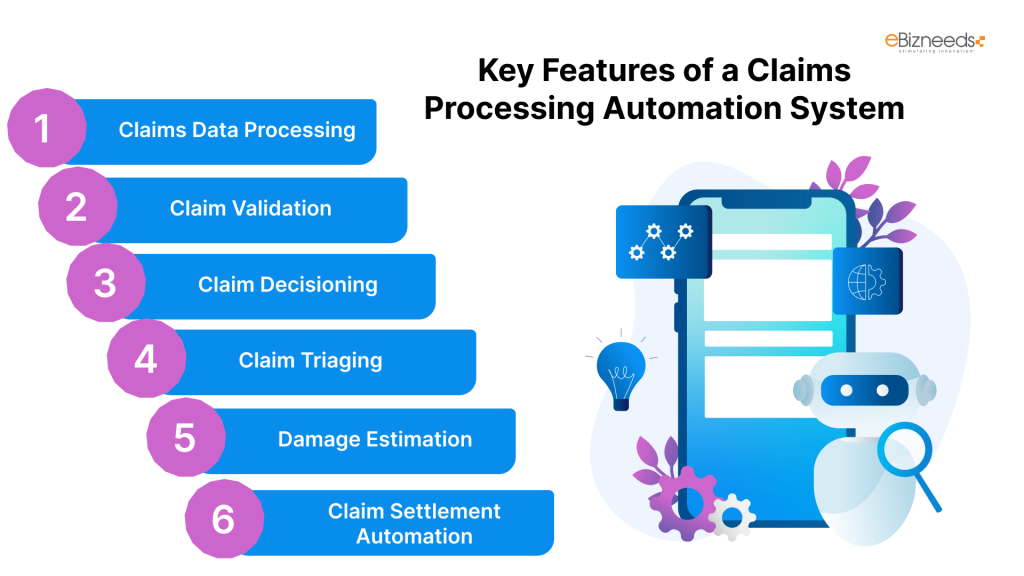

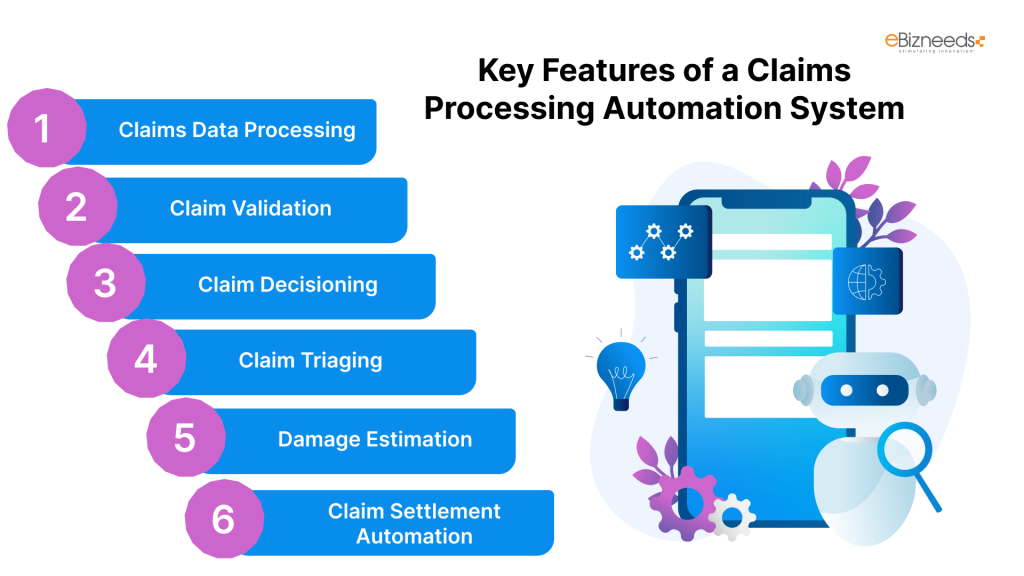

Key Features of a Claims Processing Automation System

We aim to implement high-utility features in the claim processing software. Our vision is to meet each client’s unique claim management needs. Here are the main core features that we most commonly suggest to our clients:

a. Claims Data Processing:

Automatic aggregation of claims from various channels like customer online portal, phone calls, e-mails, and others

Automatic data extraction from the FNOL ( First Notices of Loss) and claim-supporting documents

Support for claim documents in various formats, including text, image, audio, video, and even guidance on how to merge PDF files, ensures seamless and efficient handling of your submissions. Our system accommodates diverse file types to streamline processing and enhance user experience.

Automatic conversion of documents into digital format using OCR technology

b. Claim Validation:

AI-powered claim validation against insurance coverage terms using data provided by the policyholder or insurance agent, as well as data from reliable third-party sources such as medical information bureaus, police administration, GIS and telematics systems, public fraud databases, and so on.

Intelligent fraud claims detection

Routing of claims through route-based systems that will contain incomplete, inaccurate, or contradictory data for manual check

c. Claim Decisioning:

Claim approval or rejection through user-defined rules like rejection of fraudulent cases or wrongly disclosed items.

AI-powered decision-making related to claims

Instant communication of claim decisions to consumers

d. Claim Triaging:

AI-assisted claim triage based on an assessment of claim urgency, damage extent, injury severity, financial and reputational risks connected with non-settlement, and so on.

User-defined rules for claim prioritization subject to claim rate, amount, policyholder value, etc.

e. Damage Estimation:

Remote damage inspection and loss evaluation using IoT

Damage assessment through AI-powered technology using the analysis of claim-supporting documents and other data

Damage estimating requests are created using a template and sent to the appropriate in-house experts (for example, engineers and medical experts) or third-party damage assessment service providers.

f. Claim Settlement Automation:

AI-based suggestions for best-fitting damage-handling service providers

Automated claim payments that include compensation payments to policyholders

Domestic and cross-border claim payouts

Essential Integrations of an Insurance Processing Claims Software:

It is essential that you integrate third-party systems with the insurance claims processing system development to achieve a higher degree of automation.

Customer Interaction Channels: It could be a customer portal, e-mail services, messaging services, a business phone system, or any portal that customers can use to intimate claims.

Policy Administration System for streamlining claim validation

Third-party data sources: These can be internal systems for medical information bureaus, police administration, etc. for data-driven claim decisioning and damage assessment.

Tracking Solutions: It includes IoT ecosystems, computer vision systems, and asset monitoring software of the insurer, commercial customers, third-party telematics, and others.

Vendor Management Software: It is essential for the prompt selection of optimal health and repair service providers to recommend to policyholders subject to damage.

Accounting System: The accounting system helps in recording claim payment transactions in the general ledger.

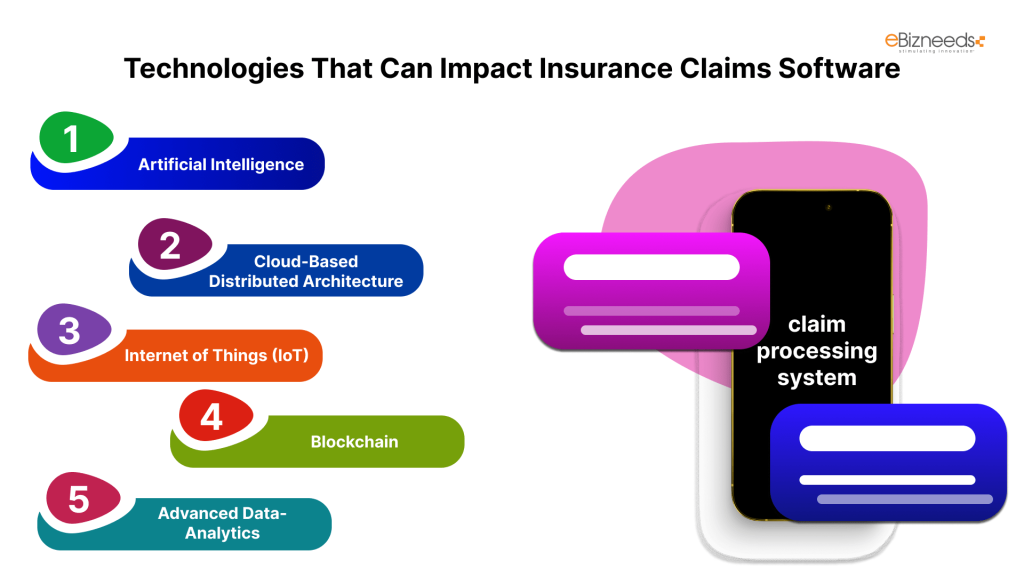

Technologies That Can Impact Insurance Claims Software:

Here are the major technologies that can impact insurance claims software:

a. Artificial Intelligence:

AI with its abilities of predictive analytics can have a huge impact on insurance technology. It can automate most of the tasks of claim processing, supporting human decision-making with machine intelligence. This “human in the loop” strategy boosts efficiency and enhances customer relations by personalizing touchpoints.

b. Cloud-Based Distributed Architecture:

For modern insurance operations, you can’t neglect cloud computing technology. It aims to provide scalable and resilient solutions. Insurance companies can use cloud computing for improved catastrophe recovery and scalability. It will distribute the data and apps on multiple sites.

c. Internet of Things (IoT):

The IoT technology serves the purpose of providing real-time data insights. The risk assessments related to policies would be more accurate with IoT. It will also provide insights into customer behaviour and asset conditions along with dynamic policy adjustments and proactive risk management.

d. Blockchain:

Blockchain technology is a decentralized digital ledger that brings transparency in insurance transactions. It helps in creating tamper-proof records of transactions and smart contracts. Thus, there will be less fraud and more trust, and the claim processes will be more reliable and efficient.

e. Advanced Data-Analytics:

In the insurance industry, data analytics will allow insurance companies to utilize vast amounts of data on claims, customers, quotes, policies, etc. and make informed decisions. It helps in accurately predicting pricing models, optimising underwriting processes, predicting claims, and leading to better risk management.

How to Develop Insurance Claim Processing System Software: Steps To Follow

Here are the major steps that you are required to follow for comprehensive and high-value insurance claim software:

a. Research:

You have to identify the requirements by researching the needs of all involved stakeholders. It includes the agents, claim processing team, underwriters, and other stakeholders. You have to also conduct research to understand market trends, competitive products, and emerging technologies.

You must outline a detailed requirement plan entailing timelines, scope, features, and functionalities.

b. Hire a Software Development Company:

After creating the project requirement document, the next step is to find a reliable software development company that can understand and meet your requirements. To hire software developers, you must give high preference to their experience, expertise, and relevant skills. The chosen software development company should have great client feedback and reviews & ratings.

c. Design:

The design of the software should be captivating and attractive for all the involved stakeholders. At Ebizneeds, our UI designers aim to create a beautiful yet professional design that suits the client’s requirements.

d. Development:

After the creation of the design, the next responsibility of developers is to bring that design into functional software. The front-end developers have to ensure that the design elements work seamlessly on all devices and screens. On the other side, the backend developers would be responsible for developing all the features and functionalities mentioned in the scope of work.

e. Quality Assurance and Testing:

The role of testers or QA specialists is to ensure that there will be no persisting bugs in the software. They will check the software for all underlying issues and report the identified issues to developers. The QAs will also check the software for performance and security aspects.

f. Deployment:

When the QAs will give the final sign-off, the software is now ready to deploy on the cloud infrastructure. We provide a smooth and efficient deployment process so that nothing goes south. We manage the migration of existing data to the new system while ensuring data integrity and consistency throughout the process.

Tech Stack for Insurance Software Development:

| Purpose | Technology |

| Frontend Development | HTML5, CSS3, JavaScript, React, Angular, Vue.js |

| Backend Development | Java, Python, C#, Spring Boot, Django |

| Database Development | MySQL, PostgreSQL |

| Cloud Infrastructure | AWS, Microsoft Azure, Google Cloud |

| Other Technologies | AWS API Gateway, Azure API Management |

Wrapping Up:

In this article, we have gone through all the major aspects of insurance claims processing System development. At Ebizneeds, we have expertise in developing fully functional software with advanced features and functionalities.

We will understand your requirements in a comprehensive manner and provide you with the right consultation. Let us know your requirements.

Naveen Khanna is the CEO of eBizneeds, a company renowned for its bespoke web and mobile app development. By delivering high-end modern solutions all over the globe, Naveen takes pleasure in sharing his rich experiences and views on emerging technological trends. He has worked in many domains, from education, entertainment, banking, manufacturing, healthcare, and real estate, sharing rich experience in delivering innovative solutions.