Last updated on March 28th, 2024 at 06:18 am

In the modern world, where life is fast, the feasibility of controlling finances from anywhere becomes vital. And nothing is better than bringing it to the smartphones that are omnipresent in this ever-growing digital world. So, it is not a surprise that many people prefer mobile banking apps for their financial transactions. With the banking sector going digital, the market is swamped with numerous mobile banking apps, making it a lucrative investment. However, if you intend to join the hype, you must have a good idea about mobile banking app development. It requires careful design and technological power for security and user-friendliness that satisfy today’s customers.

So, this guide will take you through the insightful journey of creating a banking app for mobile devices, from conceptualization to implementation. Whether you are a bank seeking to develop its app or a developer who wants to understand mobile banking app development, this guide is for you.

Let’s go on to learn more about mobile banking apps and how to develop one that not only conforms to the user’s requirements but also exceeds their expectations.

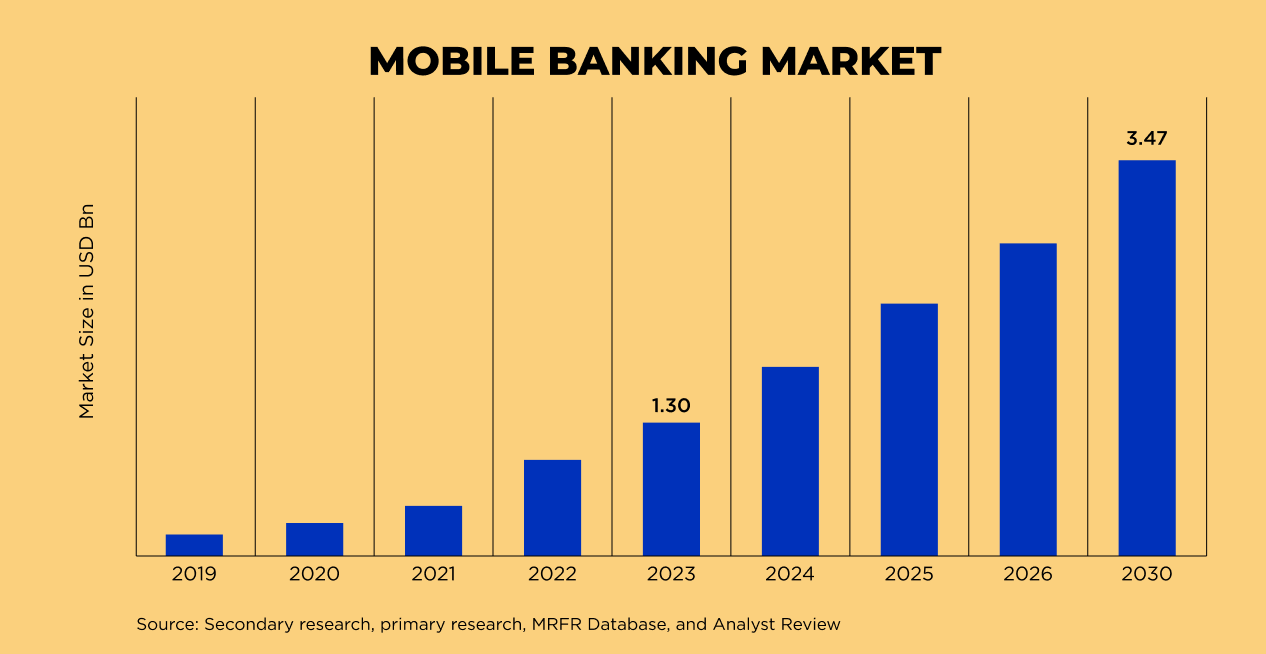

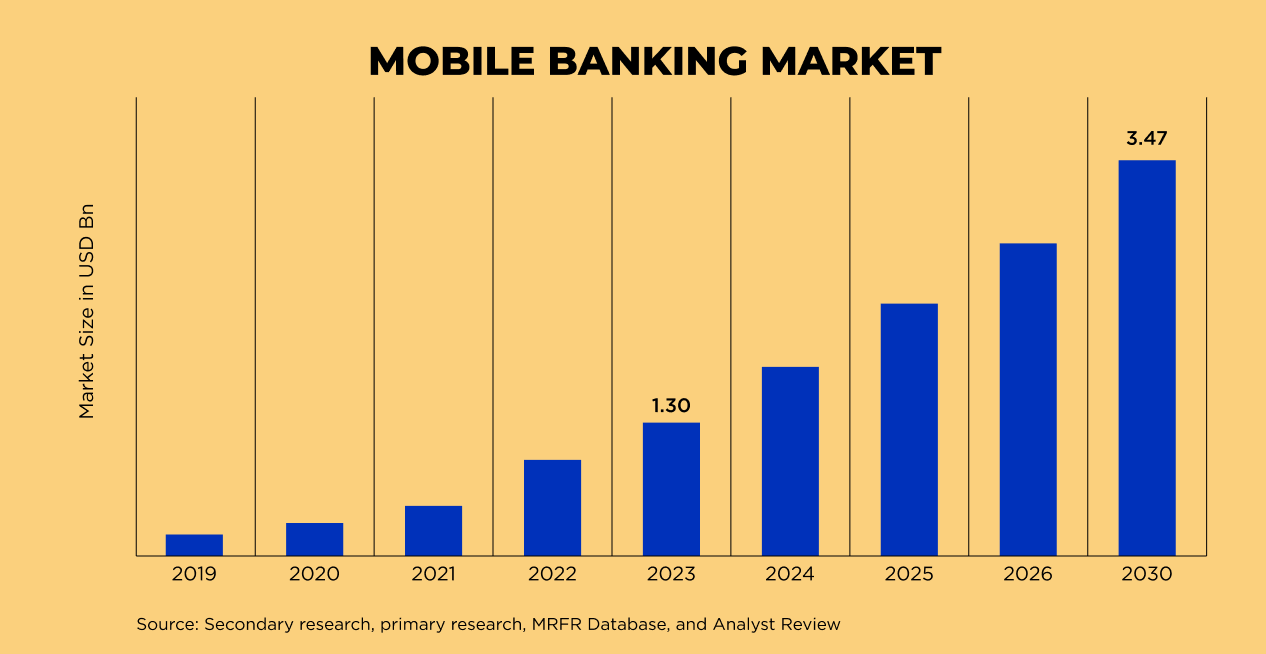

Mobile Banking Applications Market Statistics

What are Mobile Banking Apps?

Mobile banking apps are software products designed to enable users to conduct banking activities like money transfers, loan applications, and bill payments using mobile devices.

The tech-driven nature of these apps gives you the desired convenience of managing a broad range of financial tasks directly from your smartphones or tablets. So, you can keep tabs on your account balance, access your funds in different places, pay your bills, and much more with just a few taps on your device. Moreover, they are built with digital security in mind.

These mobile banking applications appear in different versions, and each of them has distinct advantages.

Types of Mobile Banking Apps

The most common types include traditional bank apps, neobank apps, and fintech apps.

- Traditional bank apps: The mainstream banks opt for traditional banking apps that give users access to their basic bank services like checking accounts, transfers, and bill payments.

- Neobanks: These apps provide digital-only banking with streamlined services and lower fees, offering considerable convenience to clients for their banking activities.

- Fintech apps: Fintech apps automate traditional banking services and also provide various innovative features, including budgeting tools, investment management, and P2P payments.

Irrespective of their types, all these apps commonly provide their users with convenience, accessibility, and time-saving benefits, as well as the opportunity to manage their finances wherever they are.

Key Features of Mobile Banking Apps

Significantly, mobile banking apps use the mobile-first approach for people who want to access their finances conveniently. Some of the key features that all mobile banking apps have are:

- Account management

- Fund transfers

- Bill payment

- Mobile deposits

- Alerts and notifications

- Security features

With the knowledge of what mobile banking apps are, let’s move on to understand their development process.

Planning Your Mobile Banking App

Planning your mobile banking app is the most important first step in creating a successful and client-centered experience. Just as laying a solid foundation for a building, careful planning guarantees that the app meets security standards, meets user needs, and stays within budget.

1. Define your objectives

Before you get into the process of development, you need to set project goals and determine your target audience.

Do you intend to provide banking services on a basic level, such as checking and savings accounts? Or are you intending to offer retirement planning, investment management, or loan applications in your banking app?

Having precise objectives for your app will guide the development process and ensure that it meets the needs of your users.

2. Conduct market research

Conducting thorough market research is crucial to understanding the market stance for your product. You should look into other mobile banking apps to develop your unique proposition and fill in the missing parts of the already available services. This helps you do things better and introduce your ideas more effectively.

Also, you need to go through different apps, critically assess the user reviews and testimonials, and get familiar with the customer’s likes and dislikes. Through this, you get valuable insights into the competition, market demands, and user needs. This data will help you build an app that will serve customers’ needs and be in line with their preferences.

3. Choose the right platform

Whether to create your application for iOS, Android, or both platforms is the most important decision that will affect the reach of your application and its development process. Here, consider what platform your users use, how many people are using similar apps, and how much money and resources you need to create the app.

By selecting the correct platform, you will be able to ensure greater app visibility and guarantee a smooth and pleasant user experience. Besides that, it helps you determine the development cost of the app too. That makes it easier to plan your processes.

4. Select a development approach

There are options, such as native, hybrid, and cross-platform development, to build your mobile banking app.

Native apps provide the best performance along with the user experience but are more complex to develop because each platform, like iOS or Android, requires separate development.

The use of hybrid and cross-platform frameworks is more beneficial as it allows the developer to build the app once and deploy it on different platforms, saving time and resources.

Development Process

Mobile banking app development is a broad and multifaceted process, with each stage of equal importance. It ensures that the app is feature-rich, functional, and usable for its target audience to gain their trust.

1. Design and prototyping

The first thing to do is to create a blueprint for your mobile banking app to outline the process at every stage. This includes the creation of wireframes and then prototypes that will illustrate the app’s appearance and how it works. User experience (UX) and ease of use should not be neglected in the design process to achieve an interface that is user-friendly and navigable.

2. Development and Testing

This is the stage where your idea is turned into a fully functional app with codes that bring everything together, applying the plan we had designed. Once developed, the app undergoes rigorous testing to discover and rectify any bugs or errors and is made ready for launch after all the issues are sorted out.

3. Integration and Security

An essential thing to consider while developing a mobile banking app is its compatibility with other platforms, the bank’s systems, and other third-party services. This flexible interaction, coupled with API and plugin integrations, enables various features like payments, security, notifications, etc. in the app. So the users will have zero problems with any operations.

Security is another important concern to preserve user data and their transaction details from hackers or other cyber threats. Data protection is achieved by implementing strong security measures such as encryption and multi-factor authentication to secure user information.

4. Compliance and Regulation

Non-compliance with the rules of the region and standards of the industry is the red line while developing mobile banking apps. Among them are compliance with rules like GDPR, PCI DSS, and banking regulations that ensure data privacy and set up data protection standards.

Compliance with these rules by implementing measures is an indispensable component in building users’ trust for lasting relationships and regulatory safeguards.

Launch and Deployment

Launching your banking app is a big milestone in the project when it finally hits the market. However, the process is a demanding one that is very intensive and requires a keen eye for details.

Here are the next steps to follow:

● App Store submission

The first thing is to submit it to the Apple App Store or Google Play Store. It is quite important to abide by their rules and requirements to make sure the app stands out and gets approved.

● Marketing and promotion

The next goal is to sensitize and attract users. The creation of a well-thought-out marketing strategy is an important factor that will lead to your app’s promotion.

Different channels, such as social media, email marketing, and others, can be used for outreach and to create an atmosphere of excitement about your app.

● User onboarding and support

Landing users on the created platform should be complemented with top-notch user onboarding materials and suitable customer support to ensure a good user experience.

Providing users with an introduction and helping them with troubleshooting when they encounter some problems can be a critical factor for user satisfaction and retention.

Post-launch Optimization

Post-launch maintenance becomes crucial to the long-term success of your app as a valuable product. This includes tweaking and optimizing your app as per your user feedback and performance metrics.

● Monitor performance

The established KPIs, such as user engagement, retention, and app store ratings, help you determine the success of your app and identify its weak spots. These indexes allow you to make data-supported decisions for future modifications and improvements.

● Gather feedback

Users can give feedback via surveys, reviews, and app analytics. This will serve as valuable information for understanding their likes, dislikes, and areas for improvement.

You can use this feedback to decide which features to prioritize and what bugs need to be fixed, which is a good indication that you are ready to meet customers’ needs and improve their experience.

● Continuous improvement

Updating and innovating your application through user feedback, new technology, and changes in the marketplace are all key factors for your success.

Cost to Develop a Mobile Banking App

The price range for developing a mobile app ranges from $30,000 to $300,000. The complexity of the app, its feature list, the UI/UX design, the hourly rate of developers, the location of the app development company, and other factors can all have an impact on the app’s total cost.

Conclusion

Mobile banking app development is a complex yet great process. Thus, you can put this complete mobile app development guide into practice and focusing on user experience, security, and industry compliance. Moreover, you can have a successful mobile banking app that holistically serves a digitized banking customer.

Mobile banking is a very dynamic space. However, it is important to keep track of its performance constantly, make improvements based on feedback, and follow the trends in mobile banking. In this way, your app can always trend by being flexible and responsive to users‘ necessities.

Naveen Khanna is the CEO of eBizneeds, a company renowned for its bespoke web and mobile app development. By delivering high-end modern solutions all over the globe, Naveen takes pleasure in sharing his rich experiences and views on emerging technological trends. He has worked in many domains, from education, entertainment, banking, manufacturing, healthcare, and real estate, sharing rich experience in delivering innovative solutions.